What to Do First When Selling a Fire-Damaged Property

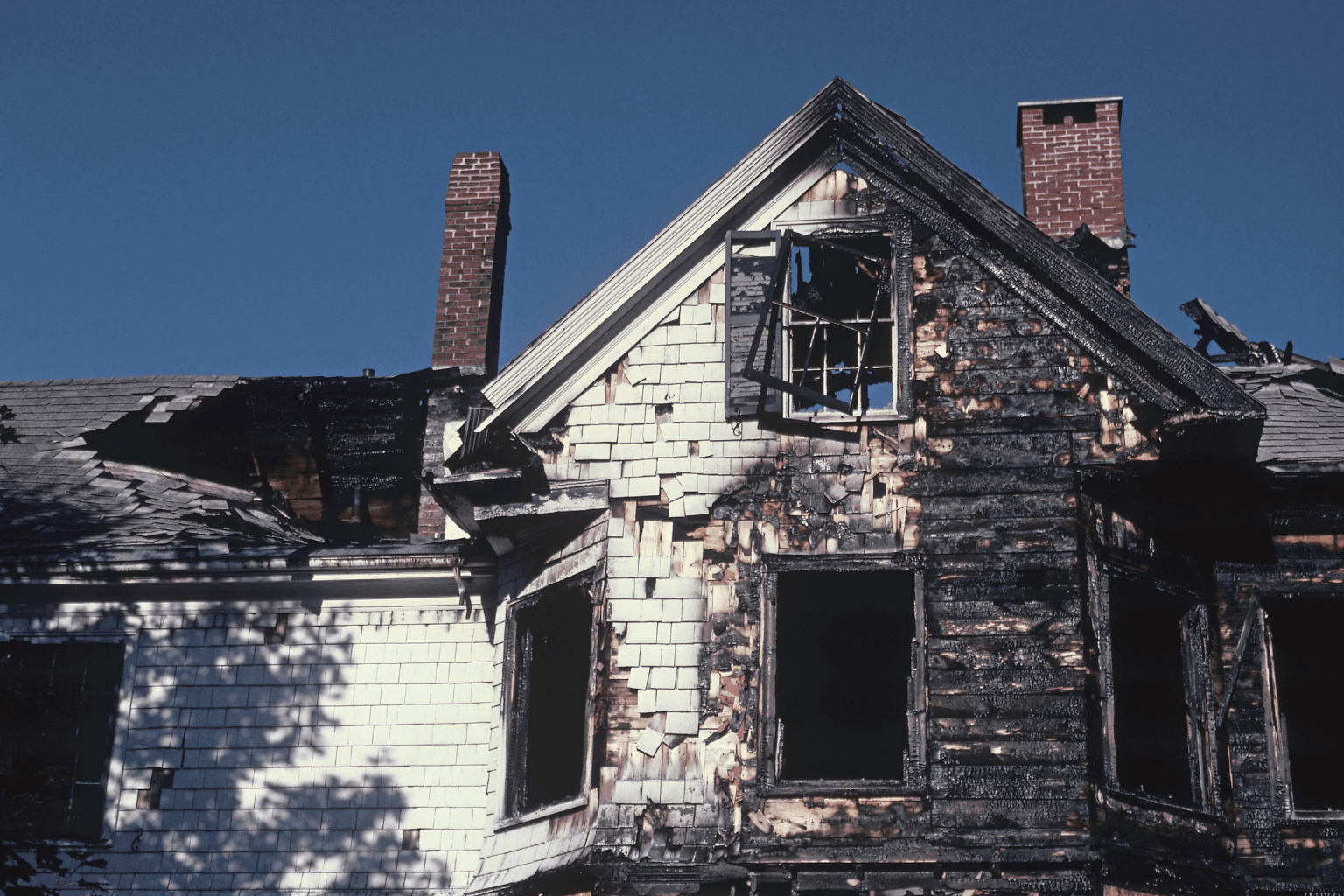

Trying to sell a fire-damaged home in California? It may feel overwhelming, but with the right steps, it’s doable. Start by assessing the damage and documenting it for insurance and legal purposes. From there, you can decide whether to repair or sell as-is. Each path has its pros and cons.

It’s also important to follow California’s strict disclosure laws and work with professionals who understand the unique challenges of selling a damaged property. Let’s break down how to sell your fire-damaged home quickly, legally, and smartly.

Must-Read Alert: While you're here, you might want to check out How to Sell a Fire Damaged Home Quickly. It’s gaining serious traction and offers more insight into selling fire-damaged properties.

Assessing the Fire Damage

Before you can sell your fire-damaged home in California, you need to understand the extent of the damage.

Document Everything

Start by taking clear photos and writing detailed notes. This helps you with insurance claims and ensures transparency during the selling process.

If you’re navigating a total loss or severe fire issues, our step-by-step fire-damaged house guide can help you explore your selling and repair options in greater detail.

Look for Hidden Issues

Fire can cause more than just visible damage. Hidden structural, electrical, and plumbing problems can affect your home's safety and value. Hire professionals for a full inspection.

Your Selling Options in California

You have two main choices: fix the home or sell it as-is. Here’s how to decide.

Repair vs. Sell As-Is

Repairing the home may bring a higher sale price, but it takes time and money. Selling as-is offers a faster sale with less hassle but possibly a lower price.

Factors to weigh:

- Repair costs vs. potential return

- Time and effort involved

- Buyer expectations

- Your financial goals

Understanding California's Disclosure Laws

Disclosure Is Not Optional

If you want to sell a fire-damaged home in California, you must disclose the damage to buyers under California Civil Code § 1102. Failure to do so can result in lawsuits or canceled sales.

- Provide a complete Transfer Disclosure Statement (TDS)

- Share repair history and remaining issues

- Include inspection reports and insurance documentation

Being honest protects both you and the buyer.

Navigating Repairs and Renovations

If you choose to repair the property before listing, do it right.

Hire the Right Contractors

Only work with licensed, insured contractors experienced in fire restoration. Ask for references, and check for past work on similar properties.

Curious how fire damage might overlap with code violations or condemnation? Watch this video: What Makes A House Condemned? to learn more about structural risks and red flags.

Make Smart Fixes

Do a cost-benefit analysis to see which repairs offer the highest return. Prioritize:

- Structural integrity

- Electrical and plumbing

- Roof, walls, and floors

- Basic cosmetic upgrades

How to Price a Fire-Damaged Home

Setting the right price is essential when you sell a fire-damaged home in California.

Get a Professional Valuation

A licensed appraiser can assess your home’s value post-damage. Use this to guide your pricing strategy.

Factor in Insurance Claims

If you received a payout, you may be able to reinvest in repairs or adjust your asking price accordingly.

Effective Marketing for a Fire-Damaged Property

Highlight the Positives

Even a damaged home has potential. Focus your marketing on:

- Recent repairs or upgrades

- Clean inspection reports

- Opportunity for investors or house flippers

- Fire safety improvements

Use clear photos and honest descriptions to attract serious buyers.

If your property is located in Sonoma County, check out our local services for selling your house fast in Windsor, CA.

Work With Real Estate Experts

Why a Specialist Helps

A real estate agent who understands how to sell fire-damaged homes in California can:

- Help with pricing and disclosures

- Market the home to the right audience

- Handle buyer concerns and legal paperwork

- Connect you with trusted contractors and inspectors

Legal Steps to Sell Your Fire-Damaged Home in California

Understand the Legal Requirements

Before listing your property, make sure to:

- Disclose all known fire damage

- Resolve any open insurance claims

- Provide necessary inspection reports

- Follow all California real estate disclosure laws

Conclusion

Selling a fire-damaged home in California isn’t easy—but it is possible. By assessing the damage, choosing the right selling method, pricing smartly, and following disclosure laws, you can move forward with confidence.

Whether you choose to repair or sell as-is, working with professionals can help you avoid pitfalls and sell your home quickly and legally. Take the next step today—your successful sale starts with the right plan.