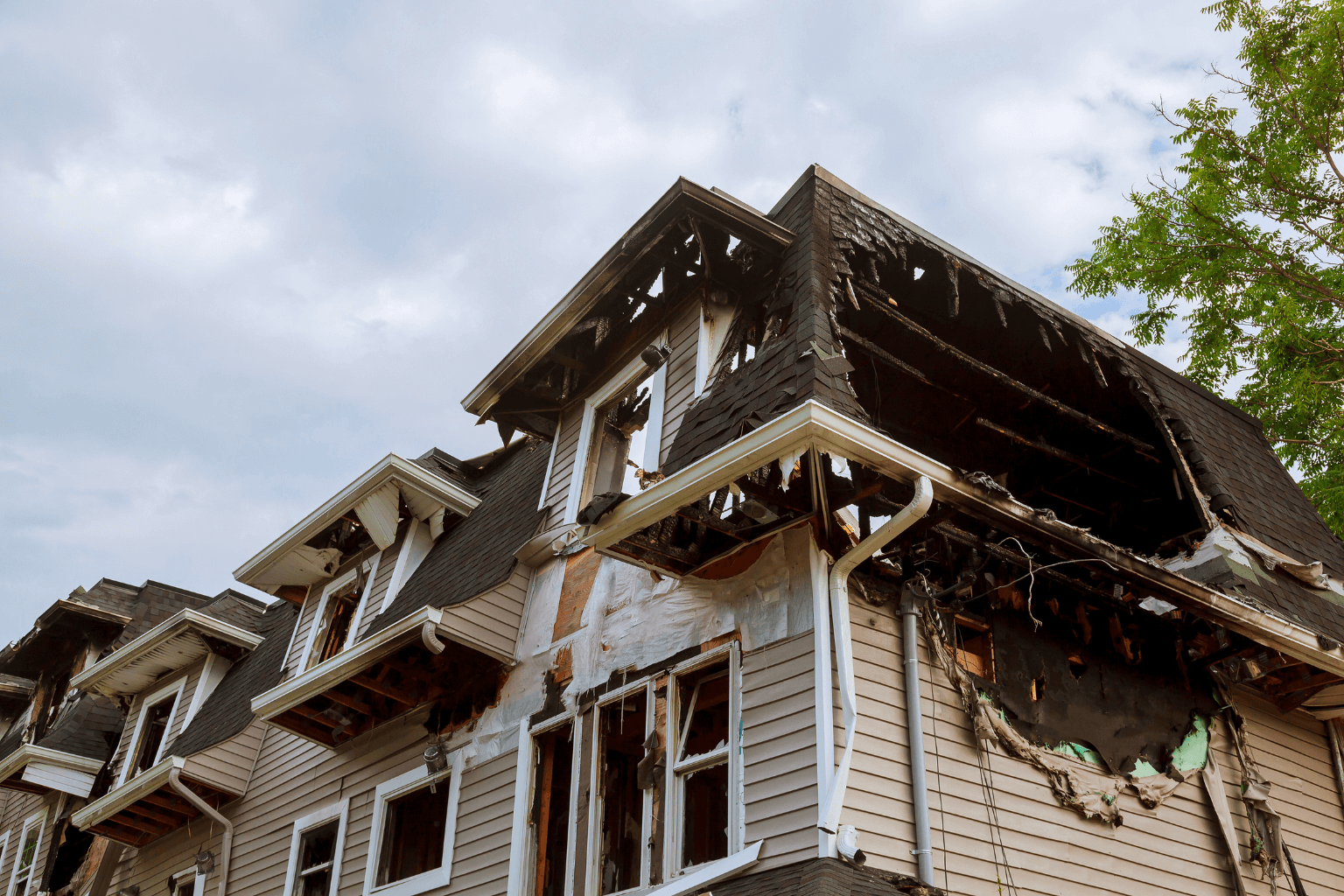

How Fire Damage Affects Your Home’s Market Value

The value of a fire-damaged house typically decreases significantly, depending on the severity of the damage and the cost of repairs. While some homes only suffer from light smoke damage, others may need complete structural renovations. Buyers may be hesitant due to concerns about hidden issues, safety, or ongoing maintenance. However, not all fire-damaged properties lose value equally. Location, insurance, and proper assessment play significant roles in determining the actual value of a home after a fire.

Must-Read Alert: While you're here, check out How to Sell a Hoarder House in California. It's gaining serious traction.

Understanding Fire Damage and Its Impact on Property Value

When a home experiences fire damage, its market value is immediately affected. This isn't just because of the visible destruction—many buyers fear what they can't see: lingering smoke damage, weakened structures, and unknown future costs. That's why the value of a fire-damaged house often depends on more than just the fire itself.

Having fire insurance helps ease the financial burden, but sellers still need to be transparent about any damage. Disclosing past fires and providing proof of repairs can enhance buyer trust and, in some cases, preserve the home's resale potential.

Suppose you're planning to sell a fire-damaged house in California. In that case, this guide outlines the key steps to take and important legal considerations.

How to Assess the Value of a Fire-Damaged House

Know the Types of Fire Damage

Not all damage is the same. Some homes may only need cosmetic repairs, while others are unsafe to enter. Fire damage usually falls into three categories:

- Minor: Small smoke stains or surface burns.

- Moderate: Some structural damage, smoke infiltration, and partial room damage.

- Severe: Major structural failure and high repair costs.

Each type influences how much a buyer may offer and whether financing or insurance coverage is even possible.

Curious how this compares to other distressed properties? This YouTube video on selling a condemned house clearly explains your options.

Check the Structural Safety

A home inspection is critical. Hire professionals to evaluate the walls, roof, and foundation. If the structure is no longer sound, the house may only be worth the land it sits on. This evaluation directly influences the value of a fire-damaged house in any market.

Calculate Repair Costs

Repair expenses can vary widely. Cosmetic fixes, such as repainting, may seem minor, but deeper structural work can significantly increase your budget. Understanding these costs is essential in determining the value of a fire-damaged house.

Here’s a quick breakdown of typical repair costs:

Repair Type | Estimated Cost Range |

Structural Repairs | $20,000 – $50,000 |

Electrical Rewiring | $5,000 – $15,000 |

Plumbing Replacement | $4,000 – $10,000 |

Smoke & Soot Cleanup | $2,000 – $6,000 |

Roof Repairs | $5,000 – $12,000 |

Drywall Replacement | $3,000 – $8,000 |

Painting & Finishing | $2,000 – $5,000 |

HVAC System Replacement | $4,000 – $10,000 |

Total Estimated Range | $30,000 – $80,000+ |

According to the National Fire Protection Association, fires can damage areas that are not visible, such as insulation and wiring, making a professional evaluation essential.

The Role of Location in Property Value

Even after a fire, location still matters.

Neighborhood Trends

Homes in areas with stable or growing populations tend to hold value better. A fire-damaged property in a popular neighborhood may still attract interest if priced correctly.

Looking to sell in a strong market? We buy homes in various areas, including Loyola, CA, where demand remains consistent despite property condition.

Proximity to Amenities

If the home is located near schools, public transportation, or shopping areas, its value may be more resilient. Buyers are often willing to invest more if the location offers convenience and lifestyle perks.

Local Safety Ratings

Neighborhood safety, especially access to fire stations and low crime rates, can boost confidence in a fire-damaged property. Compliance with local building and fire codes may also make it easier to sell or insure the home.

Insurance and Disclosure Considerations

Insurance can help cover damages, but full disclosure is essential when selling. Sellers must:

- Notify potential buyers of past fire damage

- Provide receipts or reports from repairs

- Clearly outline any remaining issues

This honesty fosters trust and helps avoid legal issues later.

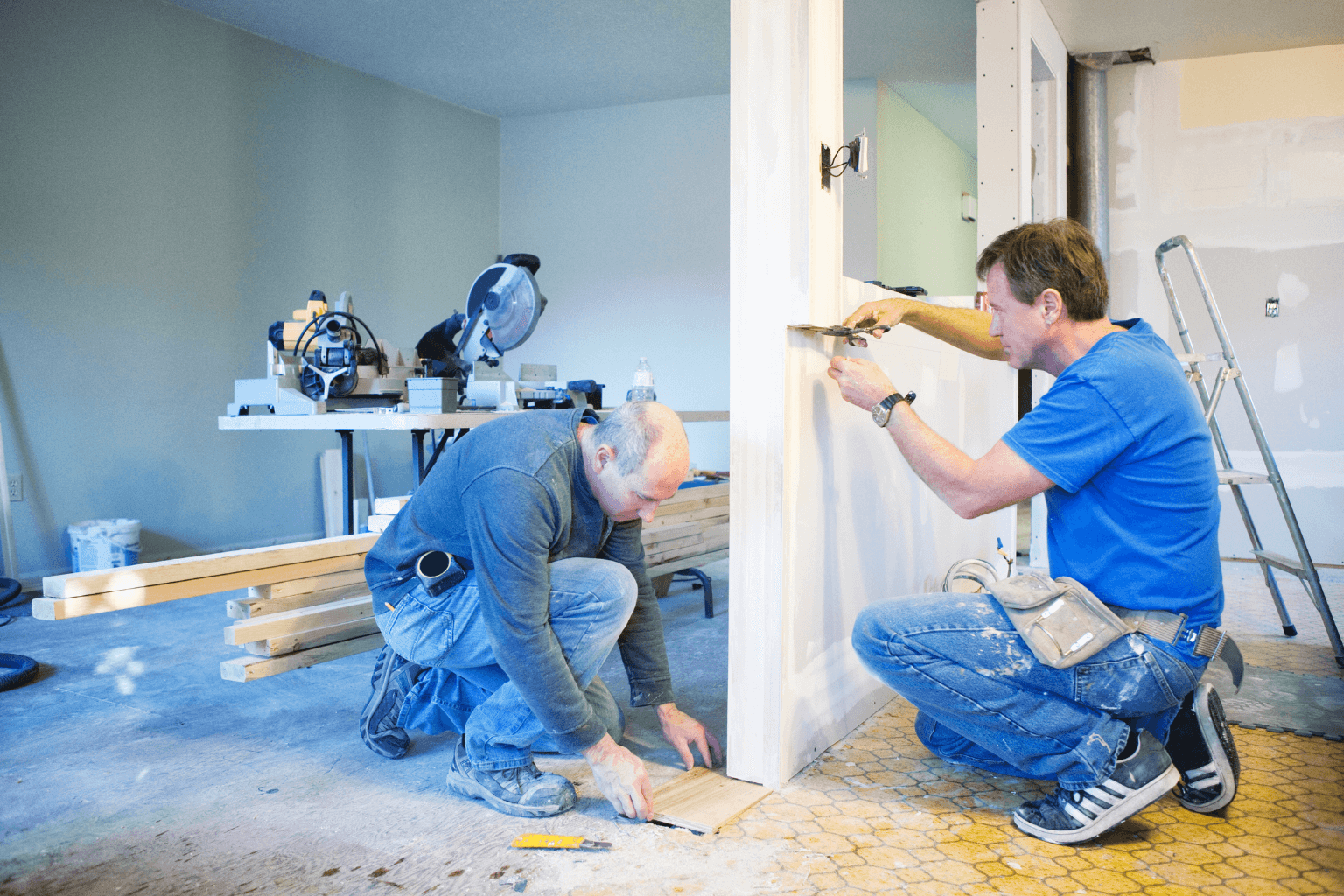

Sell or Renovate? Exploring Your Options

If you're deciding whether to sell or renovate, consider:

- Your Budget: Can You Afford the Repairs?

- Market Conditions: Is There Demand for Fixer-Uppers?

- Emotional attachment: Do you want to stay, or start fresh?

Renovating may increase the property's value, while selling "as-is" could attract investors looking for a deal.

For Buyers: Is a Fire-Damaged Property Worth It?

Buying a fire-damaged house can be a great investment, but only with proper planning. Here are some tips:

- Get a full inspection before committing.

- Estimate repairs and add a cushion for unexpected costs.

- Research local regulations to ensure you can rebuild or renovate legally.

A smart renovation can turn a distressed home into a profitable asset.

Conclusion

The value of a fire-damaged house depends on several factors, including the extent of damage, repair costs, location, and insurance status. Whether you're buying or selling, it's essential to understand the risks, thoroughly evaluate the home, and seek professional advice. With the right steps, you can make smart decisions and even turn a damaged property into a valuable one.