Things To Know Before Selling a House with Foundation Issues

Selling a house with foundation issues in California can be challenging, but it’s not impossible. Since nearly one in four homes in the state face some form of foundation problem, this is a common concern for homeowners and buyers. Whether you choose to repair the foundation or sell the home as-is, your decision will affect market value, buyer confidence, and how quickly the sale closes. California law also requires you to disclose any known foundation problems. With the right strategies, you can still attract buyers and complete a successful sale.

Key Takeaways

- Legally disclose any known foundation problems to avoid legal complications in California.

- Repairing issues can increase buyer trust and potentially raise the sale price.

- Selling as-is may attract cash buyers looking for quick purchases.

- Adjust pricing by 10–20% to reflect repair costs and condition.

- Provide inspection reports or repair estimates to build transparency with buyers.

Understanding Foundation Issues and Their Impact on Sale

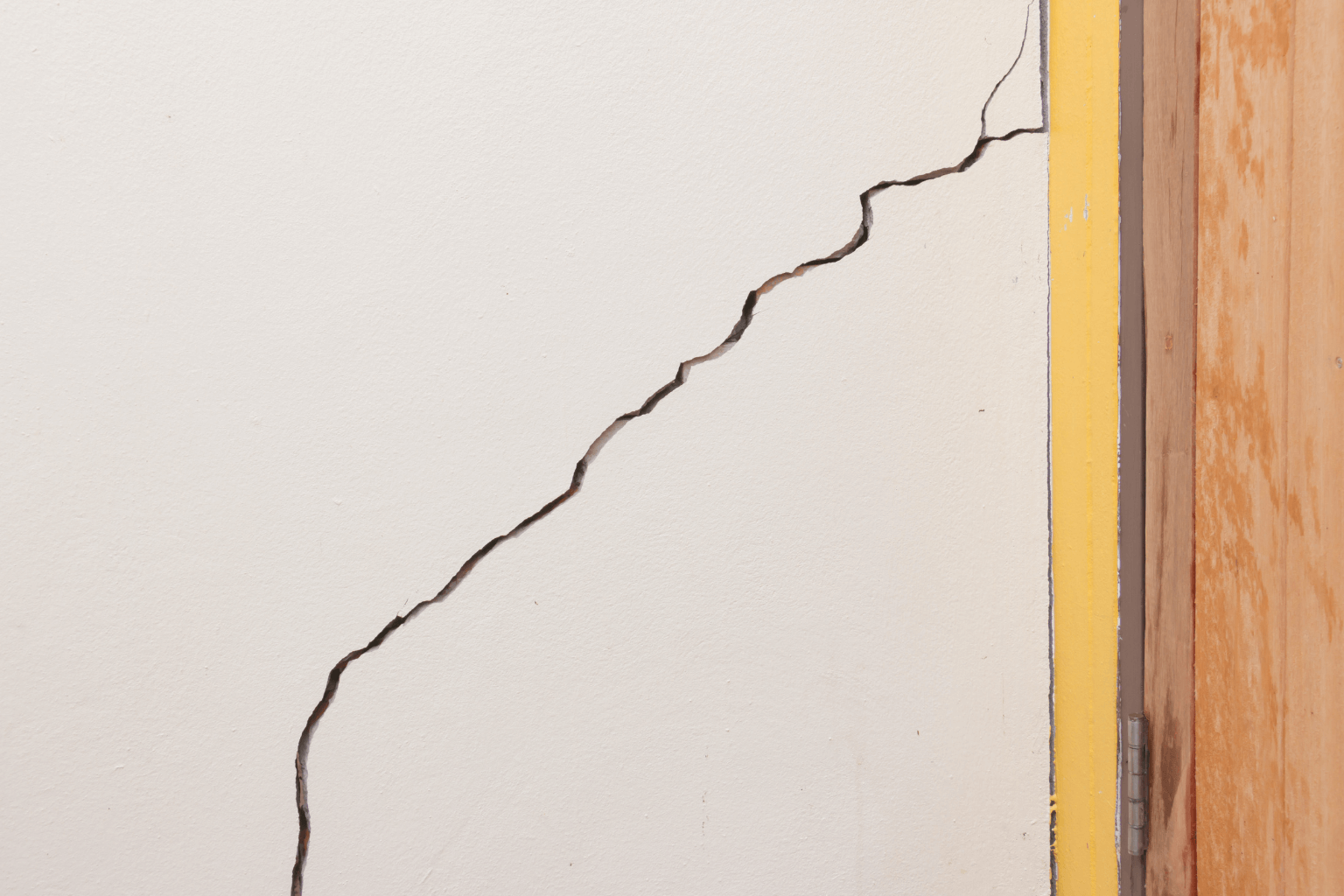

Foundation problems in California are often caused by shifting soil, seismic activity, or water damage. These issues can show up as cracks in walls, uneven floors, or sticking doors. To buyers, such signs may signal major repair costs and added risks.

Homes with foundation issues usually face:

- Lower offers, as buyers factor in repair expenses.

- Financing challenges, since lenders may hesitate to approve loans for structurally compromised homes.

- Increased buyer skepticism is making negotiations harder.

Because of these risks, sellers must also follow strict disclosure rules in California, ensuring that buyers are fully informed before making an offer. According to the California Department of Real Estate, sellers are required to provide written disclosures for known material issues to avoid future disputes.

Options for Selling a House With Foundation Issues

Repair Before Selling

Fixing foundation problems often costs $4,000–$6,000, but can restore buyer confidence and improve your home’s resale value. Repairs make it easier to pass inspections and attract traditional buyers who rely on mortgage financing.

Hot Topic You Might Love: If you're enjoying this, don’t miss our latest post — How to Sell a House That Needs Major Repairs. It’s getting attention and might just surprise you.

Selling As-Is

Selling a house with foundation issues in California as-is appeals to cash buyers and investors. This option is faster and avoids upfront repair costs but typically results in lower offers. Sellers should expect a 10–20% price adjustment to account for repair expenses.

No matter which route you choose, remember that California law requires full disclosure of foundation problems. Transparency helps protect you from future legal disputes. For some sellers, tax considerations also play a role — see our guide on capital gains tax when selling a house in California for helpful insights.

Legal Disclosure Requirements for Foundation Problems

California real estate law requires sellers to disclose any known material defects, including foundation damage. This involves:

- Providing written disclosures through forms like the Transfer Disclosure Statement (TDS).

- Sharing relevant inspection reports or contractor estimates.

Failing to disclose foundation issues can result in lawsuits, rescinded sales, or financial penalties. Being upfront builds trust and ensures a smoother transaction.

For example, if foundation issues lead to condemnation, both property owners and tenants can face complications. Here’s a helpful explainer: How Does Condemnation Affect a Lease?.

Attracting Buyers: Pricing and Negotiation Strategies

When pricing a home with foundation problems, consider lowering the asking price by 10–20% depending on estimated repair costs. Buyers appreciate honesty when you:

- Include inspection reports in the listing.

- Offer contractor bids or estimates.

- Highlight other strengths of the property, such as location, upgrades, or lot size.

You can also use foundation issues as a negotiation tool. Some buyers may prefer a price reduction, while others may request repairs. Being prepared for both scenarios makes the process smoother.

If your home is in a competitive area, location can help offset some concerns. For instance, buyers in high-demand markets like Piedmont, CA, may still show interest despite foundation challenges.

The Benefits of Selling to Cash Buyers

Cash buyers often specialize in homes with structural issues. They typically:

- Close deals quickly, sometimes in as little as 7–10 days.

- Accept homes as-is, saving sellers repair costs.

- Eliminate financing risks since no lender approval is needed.

For homeowners who want to avoid delays and repairs, cash buyers provide a straightforward path to selling a house with foundation issues in California.

Conclusion

Selling a house with foundation issues may feel overwhelming, but it’s manageable with the right approach. Whether you repair the damage or sell as-is, being transparent and strategic with pricing will help attract serious buyers. By disclosing foundation problems, considering cash buyers, and working with a knowledgeable agent, you can still achieve a smooth and successful sale.