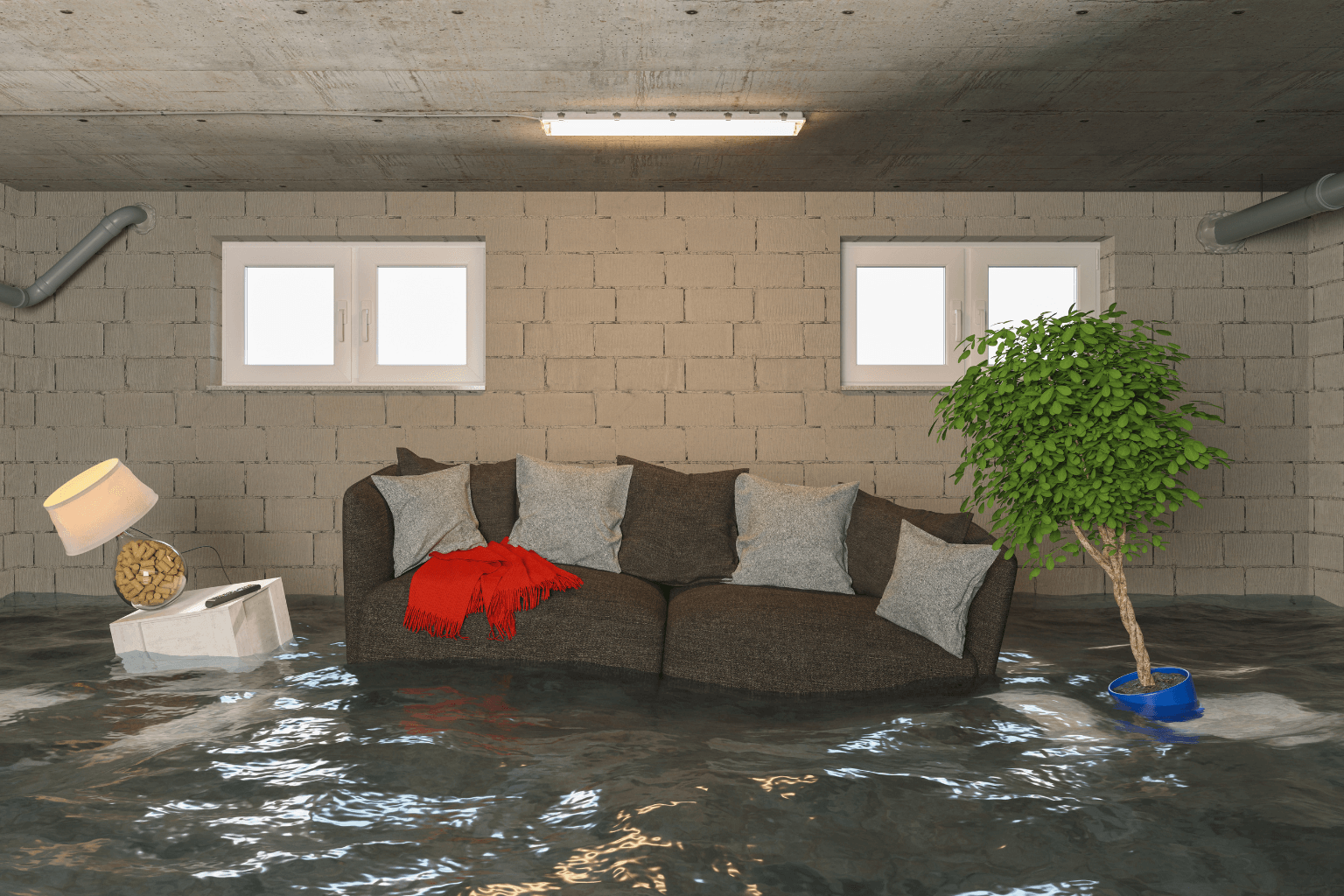

Tips for Quickly Selling a Flood Damaged Property

Selling a flood-damaged house fast may feel overwhelming, but with the proper steps, it's possible. Whether you're dealing with recent storm damage or ongoing flood issues, the key is understanding your legal responsibilities, knowing your options, and preparing your home for sale, even if it's as-is. In this guide, we'll break down how to sell a flood-damaged house fast, from understanding disclosure laws to repair tips and the benefits of working with a cash buyer.

Key Takeaways

- Price your home 10–20% below that of similar, undamaged homes for a faster sale.

- Disclose all past flood incidents to avoid legal issues and build buyer trust.

- Consider selling as-is to cash buyers for speed and simplicity.

- Make key repairs, such as mold remediation, to boost your home's appeal.

- Use clear, high-quality photos to show improvements and flood prevention steps.

Understand Legal Disclosure Requirements

If you want to sell a flood-damaged house fast, full disclosure is the first and most critical step. In states like California, it's legally required to inform buyers about any past flooding, water damage, or repairs. This includes:

- Dates and extent of past flood events

- Any insurance claims made

- Mold remediation efforts or structural repairs

Honesty builds trust. Hiding information can lead to lawsuits later and scare off serious buyers. Create a written log, attach contractor receipts, and offer a home inspection report. This transparency makes the sales process smoother and faster.

Must-Read Alert: If your flood-damaged home has developed mold, check out our in-depth guide — How to Sell a House with Mold Problems. It covers disclosures, buyer concerns, and selling strategies.

Assess and Document the Damage Thoroughly

To sell a flood-damaged house fast, document everything. Buyers and especially investors will want to understand precisely what they're walking into.

Take Photos and Videos

Take clear, high-resolution images of every affected room. Highlight water lines, mold spots, damaged drywall, and any repairs. Walkthrough videos can give buyers an even better sense of the home's current condition.

Inventory Damaged and Fixed Items

Create a list of damaged areas and any repairs made. Include receipts, estimates, and before/after photos. This step is essential for both insurance claims and buyer confidence.

Keep Repair Receipts and Reports

Save all documentation, especially if professionals were involved in the project. Certified mold removal, foundation work, or electrical fixes are major selling points that can help expedite the closing process.

Explore Your Selling Options

You can sell your house in two ways: fix it up or sell it as-is. If time is critical, you might lean toward selling as-is to cash buyers.

Cash Offer Advantages

Cash buyers often specialize in flood-damaged properties. Here's why they're a great option if you want to sell fast:

- Quick closing—usually in 7–14 days

- No repairs needed

- Lower closing costs

- No real estate agent fees

These buyers also tend to be more flexible with financing, which is helpful if the home no longer qualifies for a traditional mortgage due to flood history.

If you're based in areas like Calistoga, California, local investors often offer location-based benefits and speedier transactions.

Selling As-Is Benefits

Selling as-is means you don't need to make any more repairs. While you may need to accept a lower price, the trade-off is speed and less hassle. Some real estate investors, such as Four19 Properties, specialize in quick, fair cash offers with zero closing fees.

In cases of severe water damage or unsafe conditions, it's natural to wonder if your home is even sellable. You might find peace of mind in this helpful guide on how to sell a condemned house in California, which outlines the process and legal considerations for properties with significant structural or health issues.

Price Your Flood-Damaged House Competitively

To sell your flood-damaged house fast, pricing is everything. Buyers expect a deal when damage is involved, so don't be afraid to price accordingly.

- Set it 10–20% below the market value of undamaged homes.

- Consider how frequent the flooding has been.

- Factor in repair costs—both completed and still needed.

- Research what other flood-damaged homes in your area sold for.

A strategic price point can attract multiple offers, especially from cash buyers and investors.

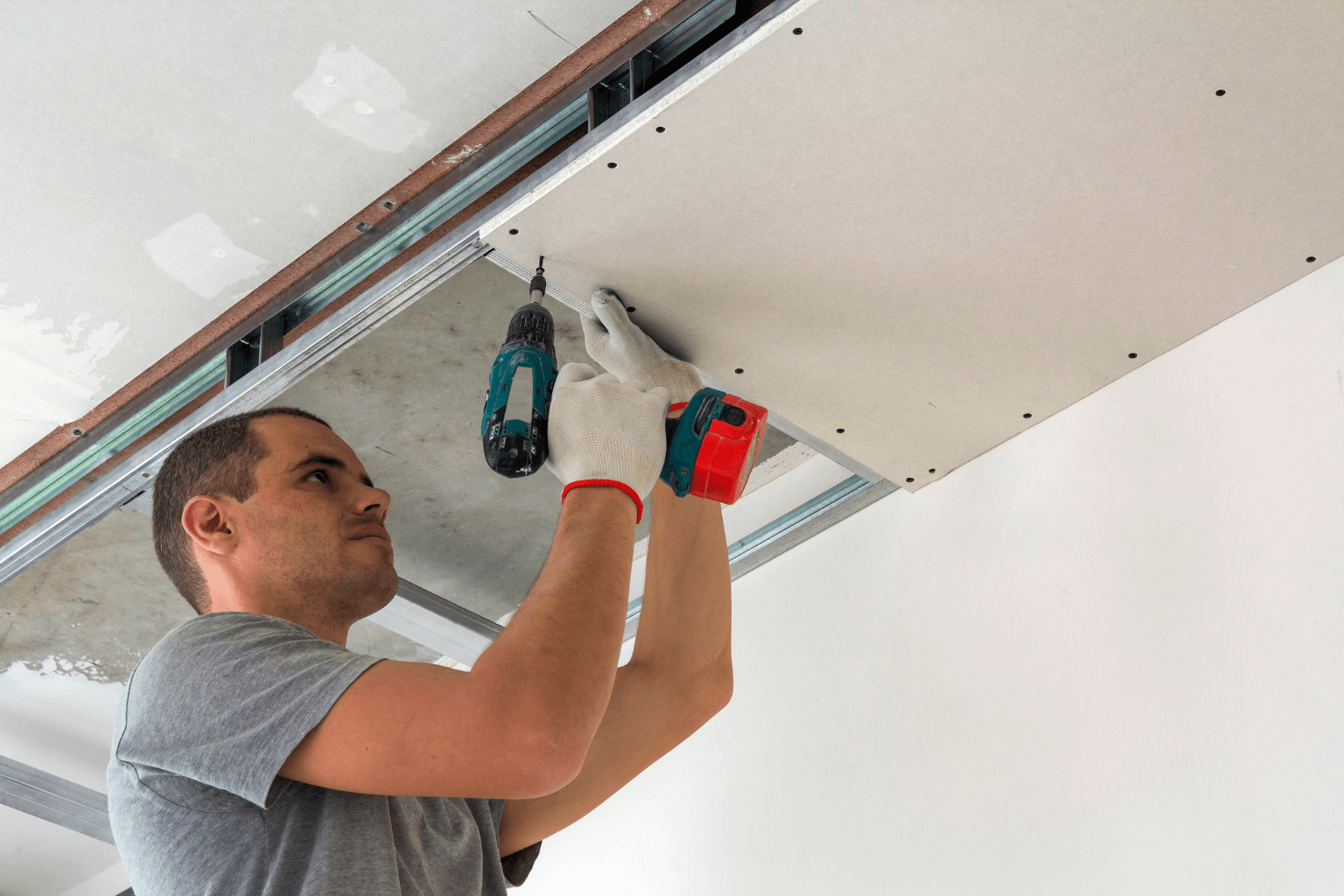

Invest in Essential Repairs (When Possible)

If you have time and budget, fixing high-impact areas can help sell the house faster and for a better price.

- Mold remediation: A must for safety and resale value.

- Drywall and flooring: Replace visibly damaged areas.

- Electrical system: Have it professionally inspected and repaired.

- Drainage improvements: Help reduce future flood risks.

Even minimal upgrades demonstrate that the house has been well-maintained, making it more appealing to potential buyers.

Additionally, if flooding has resulted in code violations or serious habitability issues, the property may be subject to condemnation. This short YouTube video explaining how condemnation affects a lease provides helpful insight, especially for tenants who are involved or when the home's legal status is unclear.

Market the Property Effectively

Once your house is ready, you need to spread the word. A well-crafted marketing plan enables you to target buyers specifically seeking discounted or distressed homes.

- Use high-quality photos and honest descriptions

- Highlight repair receipts and flood-prevention upgrades

- Promote your listing on social media, investor forums, and real estate websites

- Work with an agent who understands distressed property sales if needed

Transparency sells. The more upfront you are, the more serious and motivated buyers you'll attract.

For trusted federal advice on dealing with mold after flood damage, check out the CDC/EPA's Homeowner & Renter's Guide to Mold Cleanup After Disasters. This guide covers everything from safety gear to professional remediation steps, which are crucial for creating clean and safe listings.

Conclusion

Selling a flood-damaged house fast isn't easy, but it is doable with the right plan. From meeting disclosure laws to choosing between repairs or selling as-is, every choice brings you closer to closing. Focus on pricing smart, marketing well, and being honest about your home's condition. With effort and the right strategy, you can turn a challenging situation into a successful sale.