What to Know If One Spouse Wants to Sell the House During a Divorce

One spouse selling a home in a divorce can be emotionally and financially challenging. You may feel torn between memories and practical needs. It's important to understand your rights, set a fair price, and work with your ex-spouse calmly. This guide will help you navigate legal steps, handle offers, and divide proceeds fairly—so you can start a new chapter with clarity.

Understanding the Impact of Selling During Divorce

Emotional Readiness

Selling the home you shared can feel like closing a major life chapter. Even if one spouse is handling the sale, both parties need to feel heard and respected. Think about your personal readiness—are you making this decision out of necessity, or are you prepared to move forward?

Financial Considerations

Before agreeing to the sale, weigh your current income, debts, and housing needs. Selling might help both parties settle debts or move into more manageable housing, but only if it’s done thoughtfully.

Legal Steps When One Spouse Is Selling a Home in Divorce

Property Division and Legal Consent

If one spouse is selling a home in divorce, both parties usually need to sign off—unless a court order says otherwise. Even when only one spouse is on the deed, state laws often treat the home as marital property. This is especially true in community property states like California.

Need help after a finalized divorce agreement? Read this helpful guide on selling a house after divorce agreement in California.

What If Only One Name Is on the Deed?

Even if the deed lists just one person, the other spouse may have legal rights to the home. Learn more about property ownership through trusts in this quick YouTube video explaining how receiving a house in a trust works.

Divorce-Related Real Estate Agents Help

Hiring a real estate agent who has experience with divorce sales can make the process smoother. They understand the emotional tension and legal challenges, and they can act as a neutral third party.

Assessing Market Value Before You Sell

Before listing, get a professional appraisal and a comparative market analysis (CMA). This helps ensure you set a fair asking price based on current market trends. One spouse selling the home may want to undervalue it for a quick sale—but that can lead to disputes.

Hot Topic You Might Love: “If you're enjoying this, don’t miss our latest post — Can You Sell a House That Is in Pre-Foreclosure in California?. It’s getting attention and might just surprise you.”

Open Communication With Your Ex-Spouse

Why It Matters

Even if you’re the one selling, good communication with your ex helps prevent legal issues and emotional stress. Use respectful language, clarify your goals, and share updates on showings, offers, and negotiations.

Tools to Make It Easier

Texting or email can help you both stay civil and keep a clear record of agreements. If conversations become difficult, consider a mediator.

Handling Offers and Negotiating Fairly

When one spouse is selling a home in divorce, both may need to sign off on offers. Make sure to:

- Review all offers together (if legally required).

- Don’t rush into accepting low offers due to stress.

- Lean on your agent for advice and negotiation support.

Dividing the Proceeds Fairly

Once the home sells, how are the profits split? It depends on:

- State laws (community property vs. equitable distribution)

- Pre-existing agreements in the divorce

- Debts tied to the home (mortgage, liens, etc.)

Working with a divorce attorney or mediator can ensure everything is handled legally and fairly. According to the IRS, certain exclusions may apply to your gain if the home was your primary residence.

Equitable Distribution Factors

Understanding equitable distribution factors is essential when dividing the proceeds from the home sale. These factors help the court determine a fair split based on each spouse's situation:

| Factor | Description |

|---|---|

| Length of Marriage | Longer marriages may result in more equal division of assets. |

| Contributions to Assets | Includes both financial and non-financial contributions (e.g., home maintenance, child care). |

| Economic Circumstances | Evaluates each spouse’s current income, employment status, and financial needs. |

| Custodial Arrangements | The parent with primary custody may receive a larger share to support the child’s stability. |

| Future Earning Potential | Looks at education, career interruptions, and potential income. |

| Health and Age | Considers the physical and emotional health of each spouse. |

These elements vary by state and judge but offer a framework for achieving a fair outcome.

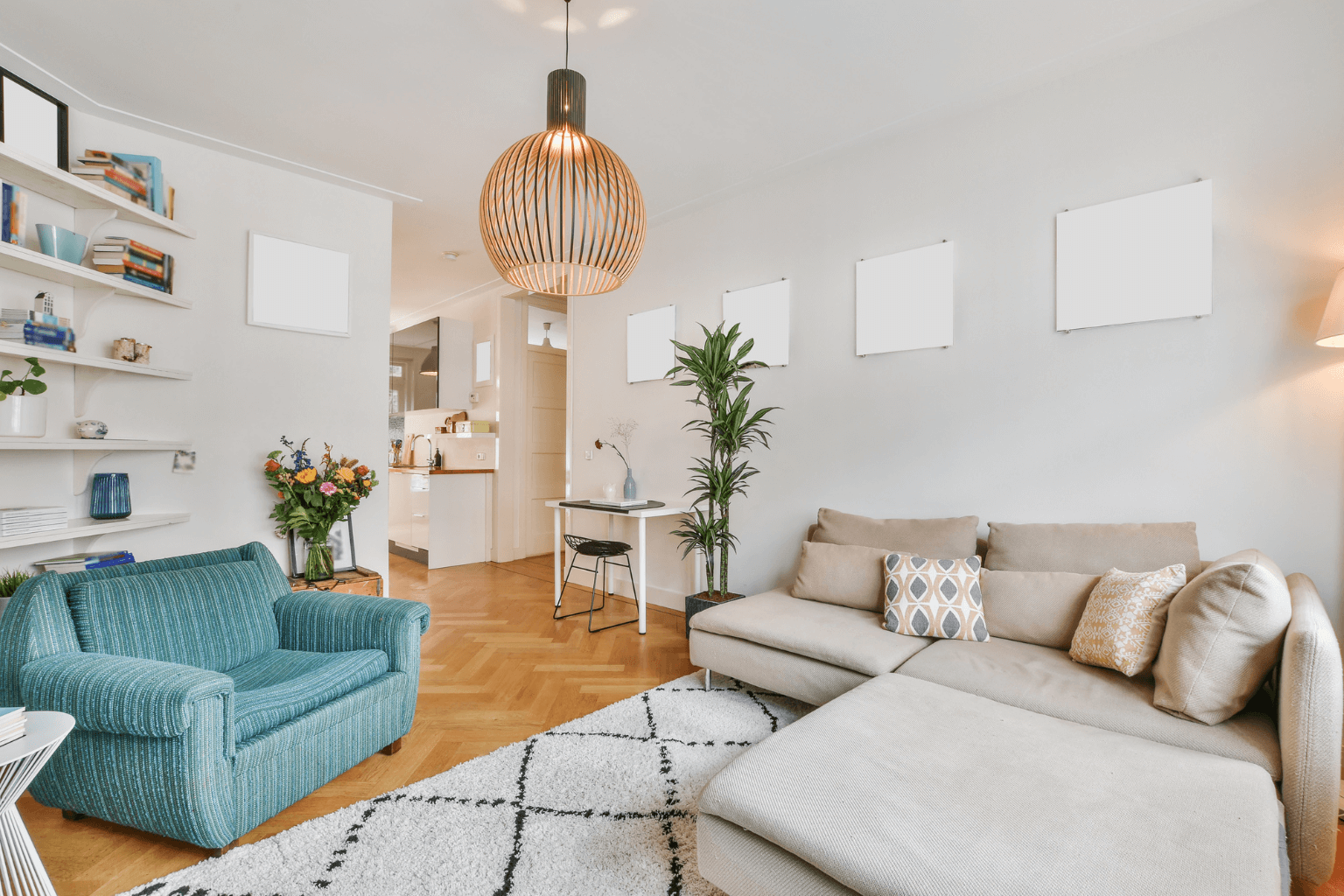

Preparing the Home for a Successful Sale

Staging and Repairs

Fix minor issues, clean thoroughly, and use neutral décor. Curb appeal also matters—mow the lawn and make the entrance welcoming.

Set the Right Price

Use pricing strategies like listing slightly below round numbers (e.g., $399,000 instead of $400,000) to attract buyers. Your agent can guide this process based on nearby comps.

When Is the Right Time to Sell?

Timing matters. If the market is hot, you might get better offers—but emotional timing is just as important. Make sure both of you are ready, both legally and emotionally, to close this chapter.

What Happens After the Sale?

After one spouse sells the home in a divorce:

- Set up separate living arrangements

- Pay off joint debts from sale proceeds if agreed

- Finalize the divorce decree and title transfer

This can be a turning point for healing and moving forward.

After the sale, don’t forget to update your local mailing address and notify essential services. If you're based in Santa Clara County, check out how we can help at our Milpitas, CA location.

Final Thoughts

One spouse selling a home in divorce doesn’t have to be overwhelming. With the right planning, legal advice, and communication, you can handle the process with confidence. Remember to consider your emotions, set a fair price, and divide the profits carefully. This can be your first step toward a new and positive chapter.